Note: Since the publication of this post, ICICI Prudential has taken action on some of the observations made. Please see the updates at the end for more details.

It seems that ICICI Prudential can’t make up its mind on how to classify its scheme, Balanced Advantage Fund.

Take the latest fact sheet, to begin with. At the start (page 7), the scheme is categorized not as an Equity fund or as a Balanced Fund but as a “Dynamic Asset Allocation” fund. In contrast, on the individual scheme page (page 56) it is described as “An Open Ended Equity Fund” and, in more detail, as “An equity fund that aims for growth by investing in equity and derivatives.” At the end of the fact sheet (page 124), where the investment objectives of each fund are given it is again categorized under the head “Equity Funds.” But here the objective is stated as providing “capital appreciation and income distribution”.

The inconsistency on its website is more glaring.

On the website, till some time ago, this scheme used to be listed under the category of “Equity Funds.” At the time of writing, it is being listed under “Balanced/ Hybrid Funds.” But when you scroll down the scheme page, among its key features, its “type” is mentioned as “Open-ended Equity fund”.

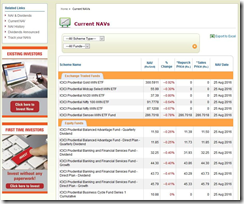

If, instead, you choose to look for its NAV on the Current NAVs page, you will find that the NAVs for its Quarterly dividend options feature under the head of “Equity Funds” while the NAVs for the other options (Dividend, Growth and Monthly Dividend) feature under the head of “Balanced Funds”.

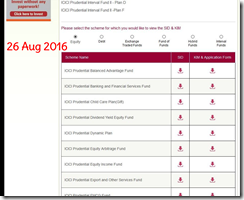

If, however, you wanted to check the KIM or SID of the scheme, you would have to look for it under the category of “Equity” funds.

So what should one make of this? Is the fund house sloppy? Or could it be something else?

If one source is to be believed, the fund house hasn’t been able to make up its mind and, bizarre as this may sound, they are “testing waters”. Quite frankly, it makes no sense to me. But then a lot of the things that the fund house has done in the past, particularly with this scheme, have made no sense to me. For instance, the fact that it changed the name of this scheme thrice within a short span of 3 years (despite no change in its fundamental attributes). Or for instance, the existence of monthly and quarterly dividend options in what is, after all, an equity-oriented scheme. My source assures me that there is method to the madness. According to him, it is through such tinkering and trying to be “all things to all sellers”, that this scheme has grown so rapidly. Knowing what I do about this scheme, I wouldn’t touch it with a bargepole.

Update (28 August 2016): A certain reader of this blog wrote in to say that he had shared this post with some of the senior management of ICICI Prudential. This morning, I noted that the scheme in question is now uniformly classified as an equity fund on its website. I can only presume that they were spurred into action by my post and/or the actions of the abovementioned reader. However, I have not received any communication from the fund house acknowledging this.

Update (22 September 2016): Another reader brought it to my notice that notwithstanding what I mentioned in the previous update, ICICI Prudential was “back to its old tricks”, as he put it. It seems that there was a banner ad on some website, for the abovementioned scheme, which on clicking, directed one to a page with the caption: ‘Balanced/Hybrid Funds’. However, in the description that followed, this scheme was referred to as an “Open ended Equity Fund”. This is the archived link to that page.